Maturity of the Crypto Derivatives Market Attracting More Institutional Investors

The maturity of the crypto derivatives market is a positive development for the cryptocurrency industry as a whole.

The crypto derivatives market is a rapidly growing market that offers investors a variety of ways to trade cryptocurrencies. Crypto derivatives are financial contracts that derive their value from the underlying price of a cryptocurrency. The most common types of crypto derivatives are futures contracts, options contracts, and perpetual swaps.

The maturity of the crypto derivatives market is one of the key factors attracting more institutional investors to the cryptocurrency space. Institutional investors are typically large financial institutions, such as hedge funds, pension funds, and mutual funds. They are looking for ways to invest in cryptocurrencies in a safe and regulated manner.

Crypto derivatives offer institutional investors a number of advantages over spot trading. First, derivatives allow investors to hedge their risk against price fluctuations. Second, derivatives can be used to gain exposure to cryptocurrencies without having to purchase the underlying assets. Third, derivatives can be traded on regulated exchanges, which provides investors with additional protection.

Benefits of Crypto Derivatives for Institutional Investors

Hedging Risk

One of the biggest concerns for institutional investors when considering investing in cryptocurrencies is the volatility of the market. Cryptocurrencies can experience large price swings in a short period of time. This volatility can make it difficult to manage risk.

Crypto derivatives allow institutional investors to hedge their risk against price fluctuations. For example, an investor can buy a put option to protect themselves against a decline in the price of a cryptocurrency. A put option gives the holder the right to sell the underlying asset at a specified price on or before a specified date.

If the price of the cryptocurrency declines below the strike price of the put option, the investor can exercise the option and sell the asset at the strike price. This protects the investor from losing money on their investment.

Gaining Exposure to Cryptocurrencies Without Purchasing the Underlying Assets

Another advantage of crypto derivatives is that they allow investors to gain exposure to cryptocurrencies without having to purchase the underlying assets. This can be beneficial for institutional investors who may not have the infrastructure or expertise to manage cryptocurrency wallets.

For example, an investor can buy a futures contract on a cryptocurrency to gain exposure to the underlying asset without having to purchase the cryptocurrency itself. A futures contract is an agreement to buy or sell an asset at a specified price on or before a specified date.

If the price of the cryptocurrency rises above the strike price of the futures contract, the investor will make a profit. If the price of the cryptocurrency declines below the strike price of the futures contract, the investor will lose money.

Trading on Regulated Exchanges

Crypto derivatives can be traded on regulated exchanges, such as the Chicago Mercantile Exchange (CME) and the Intercontinental Exchange (ICE). This provides institutional investors with additional protection, as regulated exchanges are subject to oversight by financial regulators.

Growth of the Crypto Derivatives Market

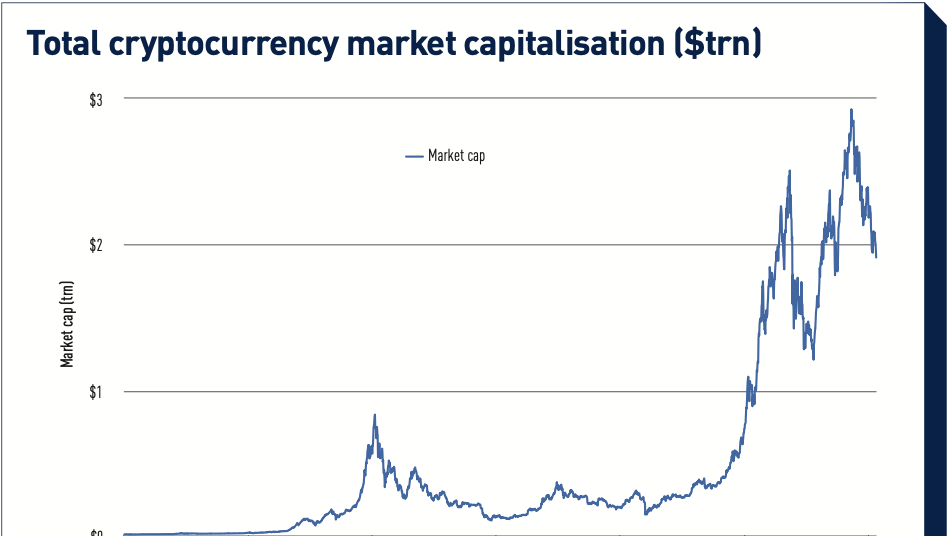

The crypto derivatives market has grown rapidly in recent years. In 2021, the total volume of crypto derivatives traded exceeded $1 trillion. This growth is being driven by a number of factors, including the increasing demand from institutional investors.

According to a recent survey by Fidelity Investments, 76% of institutional investors are interested in investing in digital assets. However, only 29% of institutional investors have actually invested in digital assets. This suggests that there is a large potential market for crypto derivatives among institutional investors.

The maturity of the crypto derivatives market is one of the key factors attracting more institutional investors to the cryptocurrency space. Crypto derivatives offer institutional investors a number of advantages over spot trading, including the ability to hedge risk, gain exposure to cryptocurrencies without purchasing the underlying assets, and trade on regulated exchanges.

The crypto derivatives market is expected to continue to grow in the coming years, as more and more institutional investors enter the cryptocurrency space.

How to Attract More Institutional Investors to the Crypto Derivatives Market

In order to attract more institutional investors to the crypto derivatives market, there are a few things that can be done.

- Improve regulation. One of the biggest concerns for institutional investors is the lack of regulation in the cryptocurrency space. Increasing regulation would provide institutional investors with more confidence in the market.

- Increase liquidity. Another concern for institutional investors is the lack of liquidity in the crypto derivatives market. Increasing liquidity would make it easier for institutional investors to trade crypto derivatives.

- Develop more sophisticated products. Institutional investors are sophisticated investors who require sophisticated products. Developing more sophisticated crypto derivatives products would make the market more attractive to institutional investors.

The maturity of the crypto derivatives market is a positive development for the cryptocurrency industry as a whole. By attracting more institutional investors

What's Your Reaction?